The digital economy comprises the economic activities enveloping people, businesses, and finances in a digital landscape. This approach includes multiple technological evolvements that address multiple industries across all sectors. Tokenization in the digital economy is one of the most modifying steps in the current situation. Traditionally, several real-world assets are illiquid as their trading was limited to the hands of institutional investors and market giants. However, with the dawn of the tokenization for business, things have been transforming at each step.

As rightly stated by William Mougayar, the general partner at Virtual Capital Ventures, an early-stage tech fund and author of the book “The Blockchain Business” that “By tokenizing assets, we can unlock value that has been trapped in illiquid markets for far too long.” His statement is quite accurate as tokenization is opening doors for several investors, including both small-scale and market giants. Let’s explore the multiple strategic benefits of tokenization in the digital economy.

Key Takeaways

– Tokenization of real-world assets and digital economy.

– How tokenization increases liquidity, transparency, and security.

– It lowers barriers to entry for investors through fractional ownership.

-Tokenization enables accessibility, trading, and global opportunities across a diverse range of assets.

– It enhances financial inclusion and provides security and transparency through blockchain technology.

1. Improving Liquidity through Shared Ownership

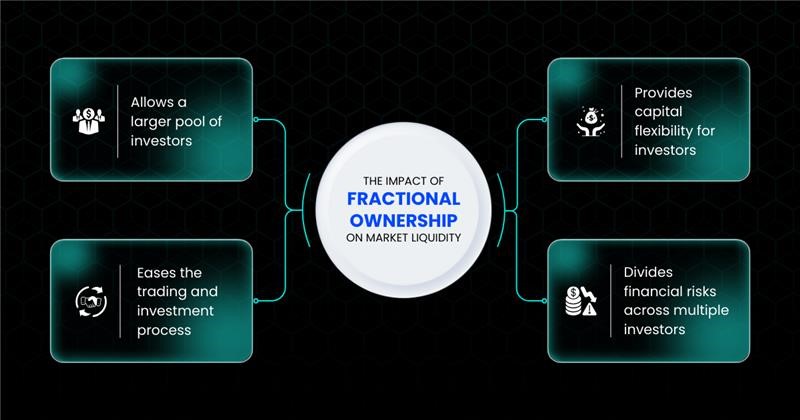

Tokenizing real-world assets allows fractional ownership in these assets, allowing investors to own smaller and tradable units. This framework makes high-worth assets like real estate, precious metals, artworks, and bullion available to a wider range of investors. The following are a few benefits of tokenization that fuel liquidity in the assets:

Broader Pool of Investors: Tokenization offers fractional ownership in the assets which reduces the minimum capital threshold. This enhances the trading and investments from the investors consisting of both retail and institutional investors.

Capital Flexibility: By leveraging tokenization, investors can purchase or sell shares or units of premium assets with ease. This permits investors to participate in trading practices as per their financial obligations.

Easier Investing and Trading: Tokenization enhances market activities by facilitating smaller investments and increasing liquidity. This makes it a lucrative option, attracting investors at a large scale.

Risk Mitigation: Tokenization by facilitating shared ownership fragments the risks among several investors by allowing investments in smaller stakes.

2. Worldwide Accessibility and Cross-Border Transactions

Asset tokenization is a digital process and so are their trading and investments, and is not confined to any specific jurisdictions, unlike traditional assets. Howbeit, tokenization allows global transactions, bypassing geographical barriers. This step has disrupted investment opportunities across the globe for investors, breaking down the barriers to the financial landscape.

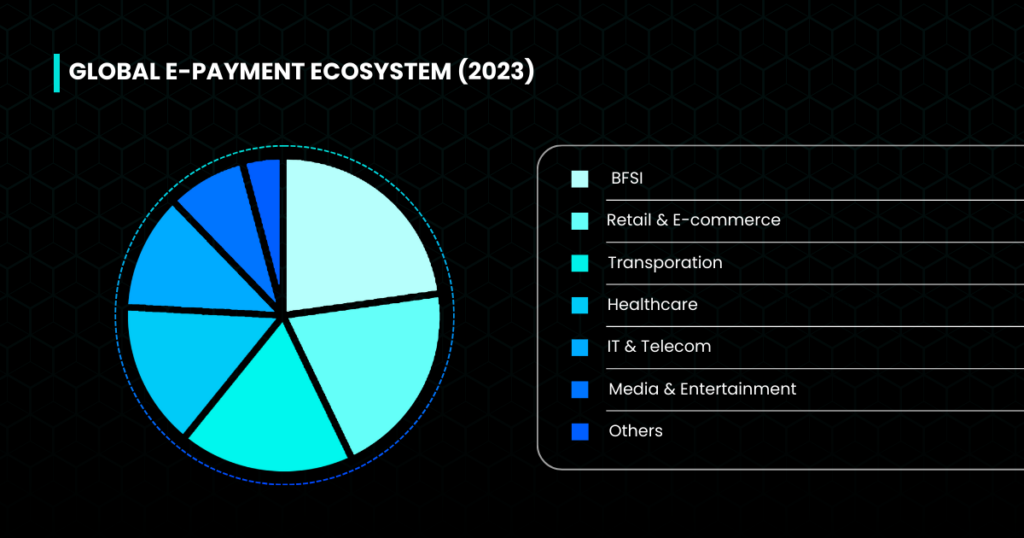

Further, real-world assets like arts, collectibles, commodities, and renewable resources are not limited to the native place but can attract investors from any corner of the world. The digital economy industry aligns with the same objective of reducing geographical barriers and extending economic thresholds to increase inclusion. The global digital market reached $96.1 Billion by the end of 2023 and is increasing henceforth. Suppose this enormous market aligns with asset tokenization, empowering more secure and transparent transactions.

3. Financial Streamlining and Elimination of Intermediaries

Tokenization in finances enables direct ownership of the assets, giving investors the power of decision-making and control over their assets. Additionally, smart contracts automate the process, eliminating the need for intermediaries, and making trading and investment a cost-effective process.

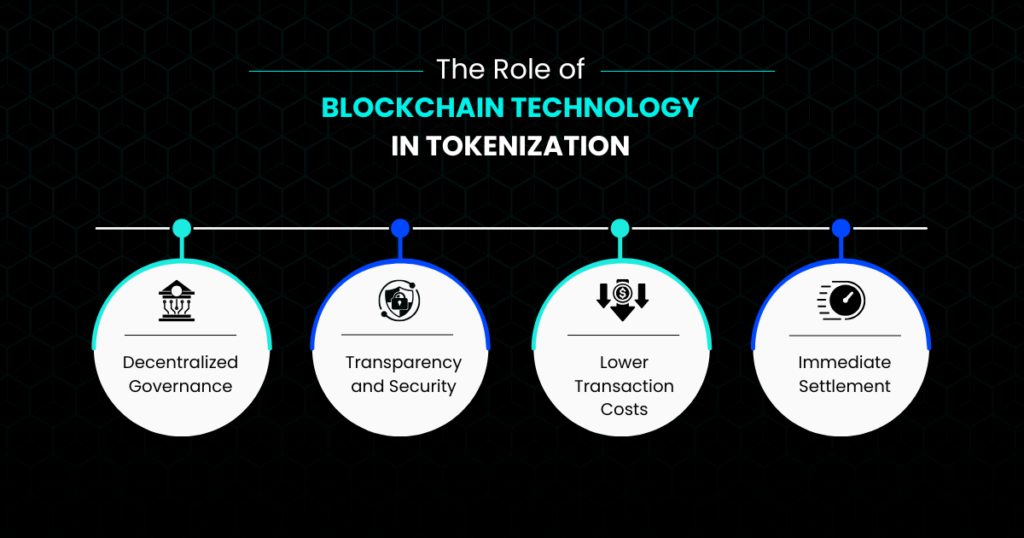

Besides, blockchain technology grants a direct transfer of ownership as well as transactions, eliminating the requirements of banks, brokers, dealers, custodians, and trustees. This approach reduces the transaction costs. Further, blockchain provides transparency, security, and decentralization, making trading and investments smoother and cheaper.

4. Greater Security and Accountability with Blockchain

The benefits of asset tokenization are not limited to just liquidity and accessibility, as it taps the potential of blockchain technology to facilitate security and transparency for the tokenized real-world assets. Blockchain technology records each transaction alongside ownership of the assets on an immutable ledger. It creates a transparent eco-system and prevents assets from any alteration or changes, reducing counterfeiting, fraud risks, or any other vulnerabilities.

- Decentralized governance reduces the need for intermediaries.

- Lower transaction fees due to the elimination of middlemen and automation.

- Quicker settlements due to automation of the process via smart contracts.

- Facilitates transparency and security as each transaction and ownership is recorded immutably.

5. Tokenization Driving Investment Access & Inclusion

Following are the ways in which tokenization empowers investors to access the financial domain and improves financial inclusion:

Lower minimum investment threshold: Tokenization allows shared ownership of real-world assets, facilitating investors with limited capital to invest in high-worth assets.

Global Investment Opportunities: Tokenization and trading of the tokenized assets are both digital processes that do not require physical presence. This increases cross-border transactions, allowing investors to invest and trade from any corner of the world.

Participation in Alternative Assets: Tokenization facilitates investors to access multiple asset classes, allowing diversification in investment portfolios. This distributes risks among several investors.

Faster and Cheaper Transactions: Tokenization enables smoother transactions as the process is automated by smart contracts. Also, it eliminates the requirements of intermediaries, reducing the related fees and making it affordable for investors.

As tokenization in real-world assets is gaining momentum in the market; several platforms allow their trading and investment. One such platform is STOEX.

STOEX is backed by KALP Distributed Ledger Technology (DLT) and strictly adhered to regulatory compliance, ensuring transparency and liquidity. With its structured approach, stringent security, and commitment to compliance, the platform offers an appealing option for diversified and efficient investing. Its regulation, security measures, focus on usability and customer-centric approach make it stand out as an accessible way of trading tokenized real-world assets.

Additionally, STOEX’s vision is to build a ground with reduced entry barriers and encourage a safe ecosystem for every individual interested in investing in the market. It pulls the strings of financial democratization by bridging the gap between investors and high-worth tokenized RWAs.

Final Thoughts

Traditionally, several asset classes were illiquid, and investments were practiced by the institutional investors only. This framework left small-scale investors with limited trading and investment opportunities. However, with the advent of tokenization, the trading and investment paradigm has shifted towards a more inclusive ecosystem. There are several benefits of tokenization of real-world assets including liquidity, accessibility, fractional ownership, global opportunities, diversified asset classes, security, and transparency. Tokenization for business aligns with the digital economy that aims to digitalize the financial arena.

As these concepts are still evolving, various platforms are adding to the layer of opportunities and options within these domains. One such option is STOEX, which allows investors to access the marketplace and trade effortlessly.

FAQs

What is tokenization in the digital economy?

Tokenization is the process of converting real-world assets into digital tokens on a blockchain.

How does tokenization improve liquidity?

Tokenization by enabling fractional ownership, allows smaller investors to trade units of RWAs, increasing market liquidity.

Does tokenization reduce transaction costs?

Yes, tokenization reduces transaction fees by eliminating intermediaries and using blockchain which allows cost-efficient processes.

How does tokenization enhance security?

Tokenized leverages blockchain to provide a secure ecosystem and make transactions transparent, immutable, and resistant to fraud.

What role does tokenization play in financial inclusion?

Tokenization lowers entry barriers, allowing individuals around the globe to access global investment opportunities with lower capital requirements.