Looking at the timeline from the first introduction of tokenization, it is quite visible how tokenization has been transforming investment opportunities around different classes of assets. Formerly, investments and trading of real-world assets used to take place in a traditional segment which were time-consuming and cumbersome processes. However, with the embrace of asset tokenization, the way of investment and trading has been redefined, adding layers of options and opportunities. In this blog post, we will explore what is real-world asset tokenization, how tokenization differs from traditional assets, and how investments in tokenized assets differ from traditional investments.

A Brief Overview of Traditional Assets and Investments

Traditional assets represent already established assets for investments and trading that have followed the same approach for several years. This process gave several opportunities to investors to build wealth over time and generate other revenue streams.

Types of Prominent Traditional Assets

- Stocks- Also, known as equities, they refer to the company ownership which is bought by the investors with an aim to gain profits through capital appreciation or dividend payments.

- Bonds- These are the debt instruments that are issued by governments and corporations. Bonds are comparatively less risky; however, they provide lower returns.

- Real estate- One of the most notable types of assets to get traditional investments, real estate allows investors to gain income through rents and price appreciation.

- Commodities- they encompass a range of physical goods like rice, wheat, oil, gold, and others, that help in counterbalancing inflation and market volatility.

Challenges Faced by Traditional Assets and Investments

- Market volatility and regulatory issues

- Lower returns in low-interest environments

- Liquidity issues in certain assets

- High fees and intermediary costs

- Geographical barriers and limitations

- The barrier to entry and cumbersome process

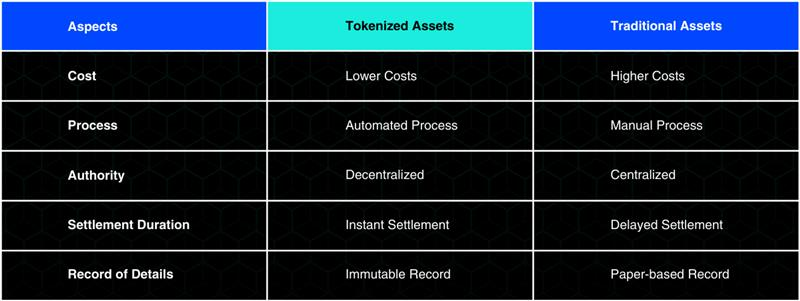

Major Distinctions Between Tokenized and Traditional Assets

Tokenizing real-world assets can contribute to the potential for improvement of the traditional domain of trade and investment. Here are a few key differences between tokenized and traditional assets:

| Characteristic | Tokenized Assets | Traditional Assets |

| Liquidity | Tokenized assets have increased liquidity due to fractional ownership. | Mostly, traditional assets are illiquid due to time-consuming processes. |

| Accessibility | Tokenized assets have democratized access that allows small-scale and retail investors to invest in high-value assets. | Due to high minimum investment requirements, these assets remain in the hands of institutional investors. |

| Ownership Model | Through fractional ownership, investors can invest in a part or unit of the tokenized asset, representing a share of that asset. | Traditional assets often require complete ownership, however in some cases, they can |

| Settlement | Transactions and investments can be settled in minutes or hours for the tokenized assets. | Transactions and investment in the traditional assets can take days and sometimes, months to settle. |

| Cost Efficiency | Investments and trading in the tokenized assets eliminate the need for intermediaries, reducing higher costs. | Traditional assets typically require intermediaries and hence incur higher costs. |

Working of Tokenization vs. Traditional Investment

Investments in Tokenized Assets

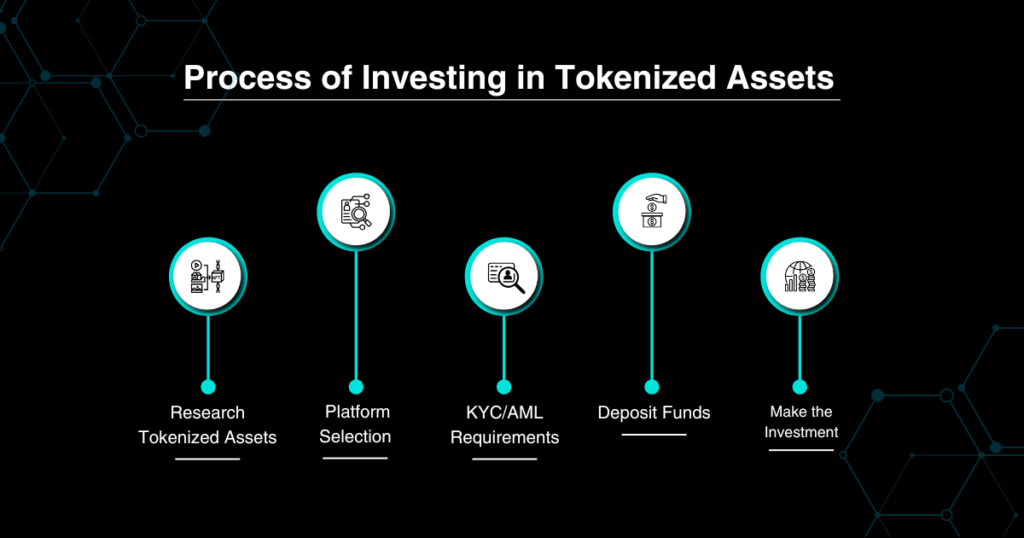

Tokenization allows investors to invest and trade in tokens of tokenized assets, including real estate, arts, commodities, collectibles, IP, and other emerging assets. It allows fractional ownership that makes investments more efficient and easier by allowing participants to own a part or unit of the tokenized assets. Further, the complete process is digital which means it allows 24/7 investments and trading. Tokenization lowers the entry barriers, opening the gate for small investors to a diverse range of assets. Further, the investment can be broadly fragmented into four steps:

- Research Tokenized Assets- The very first step is to research thoroughly the tokenized assets and identify the assets with growing market value and with potentially high returns.

- Platform Selection- The next crucial step is to select a trusted platform for the investment and trading of these tokenized assets. The platform should align with the legal requirements and follow industry standards.

- KYC/AML Requirements- Complete KYC/AML requirements as former help in the prevention of fraud and other illegal activities and latter restrain money laundering activities.

- Deposit Funds- The next step is to deposit fiat money or any other digital currency into the wallet for the transaction process.

- Make the Investment- Select the tokenized assets aligning with the intended investment goals and purchase the tokens for the assets. Confirm the transaction and gain ownership of the asset.

Investment in Traditional Assets

Investments in traditional assets incorporate the buying of physical or financial assets such as real estate, stocks, and bonds. However, it requires time-consuming processes including cumbersome paperwork, longer transactional times, and dependency on intermediaries. Broadly, traditional investment consists of the following steps:

1. Define Investment Goals- The very first step is to clear your investment goals and objectives as per portfolios. Further, assess the risks associated with the assets, and evaluate your risk tolerance.

2. Explore and Select the Assets- The next crucial step is to research the type of traditional assets (stocks, bonds, real estate, mutual funds, and commodities) you want to invest in.

3. Pick a Brokerage or Trading Platform- In this step, there is a requirement to open an account in a brokerage or trading platform to further engage in the investments in these assets.

4. Deposit Funds- The next step is to transfer funds from the bank account to that brokerage or platform account. Afterward, select the desired assets aligning with investment goals.

5. Execute the Investment- Subsequently, once the asset is selected, place the orders through the platform and complete the process of investment.

As tokenization in real-world assets is gaining momentum in the market; several platforms allow their trading and investment. One such platform is STOEX.

STOEX is backed by KALP Distributed Ledger Technology (DLT) and strictly adhered to regulatory compliance, ensuring transparency and liquidity. With its structured approach, stringent security, and commitment to compliance, the platform offers an appealing option for diversified and efficient investing. Its regulation, security measures, focus on usability and customer-centric approach make it stand out as an accessible way of trading tokenized real-world assets.

Additionally, STOEX’s vision is to build a ground with reduced entry barriers and encourage a safe ecosystem for every individual interested in investing in the market. It pulls the strings of financial democratization by bridging the gap between investors and high-worth tokenized RWAs.

Closing Remarks

To conclude, RWA tokenization is significantly gaining visibility, and the developed nations are moving towards adopting it for the process of trade and investments. This increase in their popularity is driven by multiple advantages it brings which traditional investment often restricts. These advantages include greater liquidity and accessibility, reduced need for intermediaries, several asset classes, and new investment opportunities, which are not often visible in traditional investments. Both ways of investment follow their steps, where tokenized investments unlike traditional ones are instant, secure, and transparent. As tokenization is integrating new assets, it is likely to gain more market value, howbeit, traditional investments still remain preferable options, holding a firm positioning in the global market. As these concepts are still evolving, various platforms are adding to the layer of opportunities and options within these domains. One such option is STOEX, which allows investors to access the marketplace and trade effortlessly.

Key Takeaways

- Basics of traditional assets, and their types.

- Tokenization and its advantages.

- Challenges faced by traditional assets and investments.

- Key distinctions between tokenized assets and traditional assets.

- Process of investment in tokenized assets and traditional assets.

FAQs

1. What is asset tokenization?

Asset tokenization is the process of converting the ownership rights of real-world assets into digital tokens on a blockchain.

2. How does asset tokenization differ from traditional investments?

Tokenization investments include trading of digital tokens representing rights of the physical assets while traditional investments involve gaining physical ownership of the assets.

3. What are the benefits of tokenized assets?

The benefits of tokenized assets include increased liquidity, lower fees, no intermediaries, 24/7 market access, security, and transparency.

4. Can anyone invest in tokenized assets?

Yes, anyone can invest in tokenized assets as they are accessible globally to anyone with an internet connection.

5. Are tokenized assets more secure than traditional assets?

Tokenized assets leverage blockchain technology which offers security, transparency, and immutability, reducing the risks that traditional assets do not offer.