Recently, Larry Fink, CEO of BlackRock has stated that tokenization of financial assets can be the next big thing in the domain of finance. Further, he has outlined that stocks and bonds will soon possess a unique identification code. The statements by industry giants keep emphasizing that tokenization will grow enormously, forming a giant market value. This increasing value in the market is due to the multiple benefits of tokenization. The blog post explores the basics of tokenization, its key benefits, and core components essential for tokenization projects.

Basics of Asset Tokenization

Asset tokenization is the process of converting real-world assets into digital tokens on a blockchain. These tokens represent the ownership rights of those assets. This allows investors to invest in a fraction of the high-value assets, increasing financial inclusion. Tokenized assets encompass wide classes of assets including real estate, IP, arts, collectibles, commodities, and stocks. The number of assets keeps increasing each passing day, making investments and trading in these assets more accessible than ever. Further, blockchain technology provides regulatory compliance in tokenization, making it secure and trustful for the stakeholders.

Benefits of Asset Tokenization

Fractional Ownership:

Tokenization allows investors to co-own high-value assets enabling the investments and trading in the form of tokens. These tokens are tradable units with low capital requirements. This step minimizes the entry barriers, making trading accessible to a broader range of investors.

Increased Liquidity:

By digitizing assets, tokenization encourages smoother purchasing, selling, and investing in real-world assets. This increases liquidity in the market by eliminating the cumbersome processes with automated processes.

Global Markets:

Tokenized assets are digital representations of real-world assets that can be traded around the clock on digital platforms. This increases the accessibility of investors around the globe, allowing enhanced flexibility.

Security and Transparency:

Tokenization utilizes blockchain technology that provides a secure and transparent environment for investors as well as stakeholders. This boosts the confidence of allowing them to actively participate in the market.

Diversified Portfolio:

Tokenization touches upon several real-world assets including real estate, arts, agri-commodities, precious metals, luxury goods, renewable resources, and many more. This supports investors who want to diversify their portfolios.

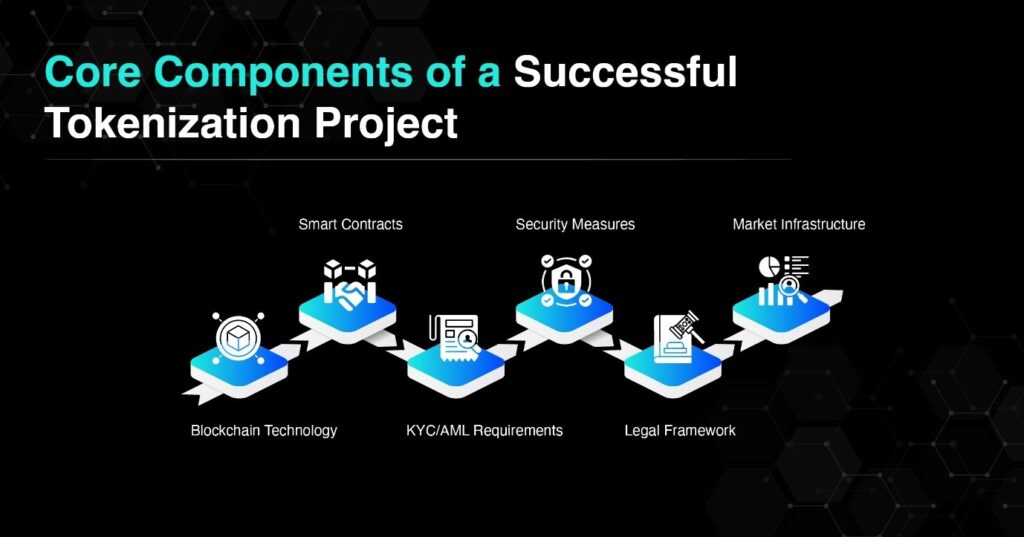

Key Pillars of a Successful Tokenization Project

Blockchain Technology

Blockchain technology is one of the most essential components of tokenization and is a foundational stone for the process of asset tokenization. It provides security, transparency, and an immutable record of ownership as well as transactions. Further, the decentralized nature of blockchain technology ensures that the data cannot be altered or erased. This approach elevates the trust of the stakeholders involved.

Smart Contracts

Smart contracts are self-executing agreements that are directly written into code on the blockchain. They automate the entire process including token issuance, transfer, and even redemption of the RWA tokens. These processes are conducted through predefined rules which eliminate the need for intermediaries. Automation in the process enhances security, efficiency, and reliability.

KYC/AML Requirements

Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements are mandatory for regulatory compliance in the projects of tokenized assets. Implementing these regulations supports verifying the identities of investors and deterring illegal and illicit activities. This strengthens security for trading the tokenized real-world assets.

Security Measures

Security is one of the most significant elements of tokenized assets for the protection of the assets, safeguarding them from risks of fraud and cyber threats. Deploying security measures like advanced cryptographic techniques, multi-signature wallets, and secure access protocols, can ensure maintaining integrity of the assets.

Legal Framework

It is very crucial to opt for a well-structured legal framework, supporting the interest of investors, sponsors, and other stakeholders involved, along with assets. Unambiguous legal guidelines establish the legitimacy of tokenized assets and lay the foundation of structured ownership rights, taxation, and compliance.

Market Infrastructure

A stable and efficient market infrastructure is vital for the process of investment, trading, and management of the tokenized RWAs. The infrastructure consists of several parts, including exchanges, trading platforms for tokenized assets, custodial services, and secondary markets. A well-streamlined market infrastructure enables a smooth investing and trading process.

Challenges and Solutions for Tokenized RWA Investment

| Challenges | Solutions |

| Ownership Issues | Implementing strong verification processes. |

| Legal Recognition | Employing a clear legal framework. |

| Vulnerabilities Around Smart Contracts | Conducting thorough audits and implementing security measures |

| Regulatory Compliance | Establishing a well-structured KYC/AML procedure. |

| Market Liquidity | Creating platforms that support trading and investments of tokenized RWAs. |

As tokenization in real-world assets is gaining momentum in the market; several platforms allow their trading and investment. One such platform is STOEX.

STOEX is backed by KALP Distributed Ledger Technology (DLT) and strictly adhered to regulatory compliance, ensuring transparency and liquidity. With its structured approach, stringent security, and commitment to compliance, the platform offers an appealing option for diversified and efficient investing. Its regulation, security measures, focus on usability and customer-centric approach make it stand out as an accessible way of trading tokenized real-world assets.

Additionally, STOEX’s vision is to build a ground with reduced entry barriers and encourage a safe ecosystem for every individual interested in investing in the market. It pulls the strings of financial democratization by bridging the gap between investors and high-worth tokenized RWAs.

Final Thoughts

As industry leaders like Larry Fink outline, tokenization can potentially bring revolution in the financial industry. Tokenization allows several benefits incorporating fractional ownership, 24/7 trade, increased liquidity, global access, and enhanced security as well as transparency. These advantages create more inclusive investment opportunities. Additionally, key components that are essential for tokenization are the legal framework, blockchain technology, smart contracts, security measures, market infrastructure, and regulatory requirements. As these concepts are still evolving, various platforms are adding to the layer of opportunities and options within these domains. One such option is STOEX, which allows investors to access the marketplace and trade effortlessly.

Key Takeaways

- Basics of asset tokenization.

- Benefits of tokenized assets include liquidity, accessibility, fractional ownership, global market, diversification in portfolio, security, and transparency.

- Core components of a successful tokenization project.

- Challenges and solutions in tokenized RWAs investment.

FAQs

What is asset tokenization?

Asset tokenization is the process of converting real-world assets into digital tokens on blockchain technology, representing their ownership rights.

What types of assets can be tokenized?

Real-world assets such as real estate, art, commodities, stocks, bonds, and even intellectual property can be tokenized.

What are the key components of a successful tokenization project?

The key components of a successful tokenization project include a legal framework, smart contracts, a blockchain platform, regulatory compliance, and a user-friendly interface.

How does tokenization increase liquidity?

Tokenization allows fractional ownership, allowing easier buying, selling, and investing in the assets, and increasing accessibility to a broader investor base.

What role do smart contracts play in tokenization?

Smart contracts automate the process of transactions, ensuring transparency, and security, and reducing intermediaries.