A Foundational Overview of Tokenization

As per one of the recent studies, the global market size of tokenization is projected to reach USD 13.20 billion by 2032, exhibiting a CAGR of 18.8%. This showcases the growing trend of tokenization and tokenized assets in the market. Now the question arises what is tokenization? Tokenization is the process of converting sensitive data as well as real-world assets (RWAs) into digital tokens. These tokens represent the ownership rights of real-world assets. Tokenization of real-world assets allows secure and transparent trading and investment of these assets and offers a wide range of entry to a wide range of investors through fractional ownership. In this blog post, we will understand the explore the basics of real-world asset tokenization, its use cases, case studies, and future implications.

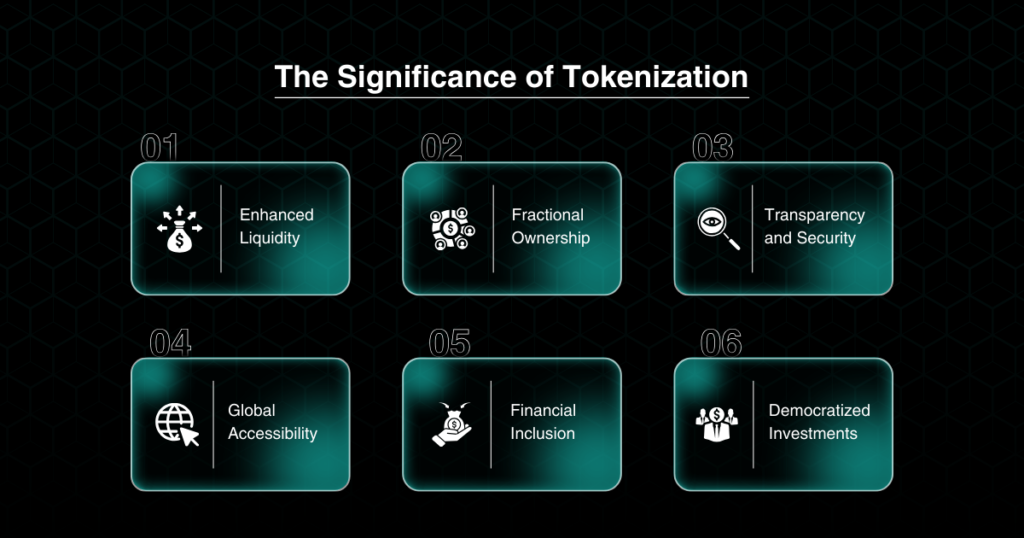

The Significance and Benefits of Asset Tokenization

The tokenization of real-world assets has improved the way investors participate in the investment and trading of these assets. They allow several benefits that smoothen the process and make it efficient for stakeholders to be involved and open new revenue streams. Here are a few of the most crucial benefits of real-world asset tokenization-

Fractional Ownership- One of the most significant advantages of tokenized RWAs is that it allows shared ownership of high-value assets including real estate, arts, collectibles, commodities, IPs, and other financial instruments. This provides investors with an edge to participate in traditionally inaccessible assets with limited and low capital.

Enhanced Liquidity- Tokenization in real-world assets provides greater liquidity as traditionally several assets were accessible to only the market giants or institutional investors, restricting small-scale and retail investors. Additionally, several asset classes including IP, renewable energy, and yachts were previously unattainable and traditionally illiquid. With the arrival of tokenization, liquidity has increased in these assets.

Transparency and Security- By leveraging blockchain technology, tokenization allows a more secure and transparent ecosystem for the investments and trading of these assets. Besides, blockchain technology also provides immutable records of transactions and ownership rights of these assets, preventing any risks of fraud.

Global Accessibility- Tokenization is a digital process where investors or any other stakeholders need not present physically for any trade or investment in these tokenized assets. This amplifies participation across the world, eliminating geographical boundaries in trade and investments, and further increasing asset classes as well as investors.

Financial Inclusion– By allowing fractional ownership, tokenization allows the participation of not just institutional investors but also retail as well as small-scale investors alike. This gives confidence to the range of investors to engage in the investment opportunities, increasing fluidity in the market.

Diversified Investment Portfolios- Tokenization allows investors to diversify their investment portfolios through investing in several asset classes. This reduces risks across several asset classes and industries, including real estate, arts, commodities, IP, yachts, bonds, and Agri-commodities.

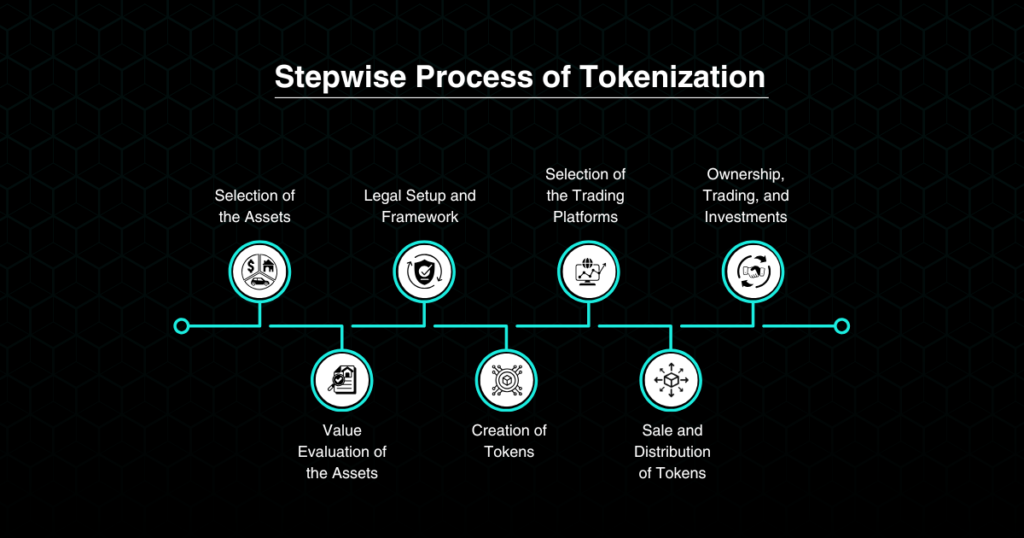

A Step-by-Step Guide to Tokenization

1. Selection of the Assets– In the pool of several assets such as real estate, IP, arts, commodities, collectibles, and other real-world assets, the asset should be selected for the process of tokenization.

2. Value Evaluation of the Assets- The next step is to conduct comprehensive research and evaluation of the selected assets, determining their worth. This is crucial for the fair price determination of the selected asset.

3. Legal Setup and Framework- Further, building a strong legal structure that ensures compliance with the regulatory framework.

4. Creation of Tokens- Another step is to issue digital tokens of these real-world assets, representing the ownership rights on the blockchain. Often, this is comprised of smart contracts for the automation of the rules and management of these tokens.

5. Sale and Distribution of Tokens- Afterwards, the sale and distribution of these tokens takes place, attracting potential buyers and investors. Here, marketing these tokenized assets is essential to define their value and growth.

6. Ownership, Trading, and Investments- Following the distribution of these tokens, they can be traded on the secondary markets or the trading platforms for tokenized RWAs.

7. Selection of the Trading Platforms- After the issuance of these tokens, another essential step in the process is the selection of the trading platforms. These trading platforms for tokenized real-world assets allow selling, purchasing, trading, and investing in these assets.

Use Cases of Tokenization in Real-World Assets

Tokenization use cases are not limited to a few real-world assets but have been expanding to several assets like renewable energies, intellectual properties, precious metals, bullions, and others. The following are the given the most prominent use cases of tokenization:

Real Estate: Tokenizing real estate converts the rights of physical property into digital tokens. Further, it allows shared ownership of high-net properties, facilitating easier trading. This increases liquidity and enhances the broader participation of the investors. Tokenizing real estate allows rental incomes while democratizing market accessibility.

Art and Collectibles: Tokenizing arts and collectibles opens the gate to investments in illiquid assets like high-worth paintings, digital artworks, and others. This makes these assets accessible to a wider audience.

Agri-Commodities: Tokenizing Agri-commodities refers to the conversion of agricultural products like grains (wheat and rice) or livestock into digital tokens. It allows better management of these commodities and in a better management.

Bullion- Tokenizing bullion like gold and silver enhances trading and investment in these assets and increases their liquidity.

Other significant assets that are being tokenized are precious metals, private equity, venture capital, and financial products.

Case Studies of Successful Tokenization Projects

Here are given a few examples of successful tokenization projects:

COSOLAR– COSOLAR is a solar power cooperative that tokenizes solar power plants. This allows exact tracking of sustainable energy in a secure and transparent environment. This shows a fine example of eco-conscious tokenization.

Braid- The first feature film to be financed through tokenization on blockchain technology, raising $1.4 million. This project illustrates how tokenization can open investment opportunities in the film industry, allowing smaller investors to participate directly in movie financing. The approach allows investors and fans to purchase the tokens that represent the film’s share.

St. Regis Aspen Resort- The tokenization of this luxury resort induces high liquidity, increased accessibility, and efficiency in the resort. This instance turned out to be the first of its kind, where each token holder was entitled to get the income from the distributions from the resort.

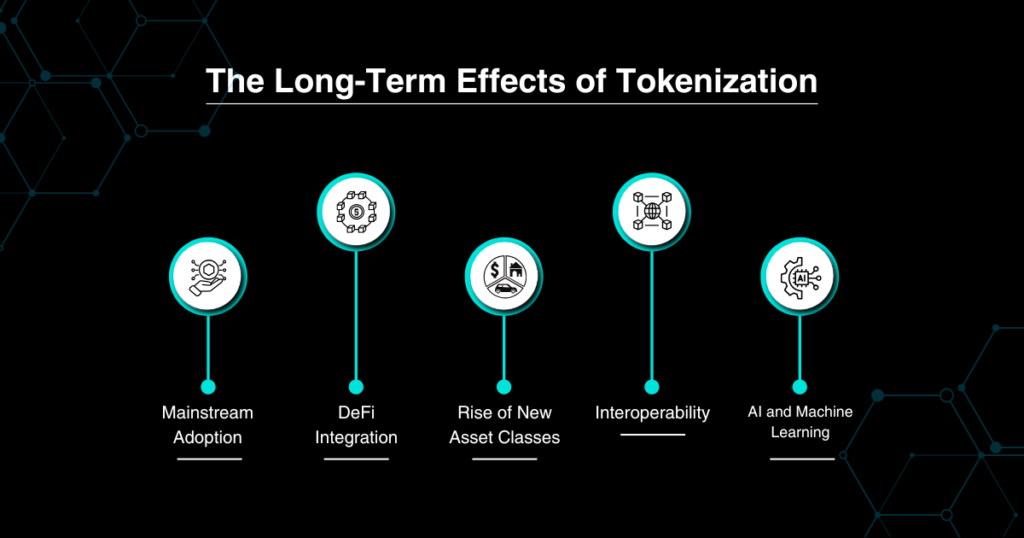

Future Implication of Asset Tokenization

Mainstream Adoption- The increasing demand and market value of the tokenized real-world assets from several emerging investors are showing rising interest in people around the world. Further, asset diversification will bring more investors and other stakeholders into the market of tokenized real-world assets.

DeFi Integration- the integration of the tokenized assets with decentralized finance (DeFi) can bring more liquidity and accessibility to the domain. Users can utilize these tokens for lending and borrowing, eliminating the need for traditional intermediaries.

Rise of New Asset Classes- Several emerging asset classes are being tokenized like carbon credits, water rights, diamonds, IP, and many more, which were traditionally difficult to invest in. This expansion and diversification of these assets can attract a large pool of investors.

AI and Machine Learning- Further applications like Artificial Intelligence (AI) and Machine Learning can optimize the asset evaluation process in the tokenization. These methods can help in detection of the fraud and other risks, facilitating better decision-making.

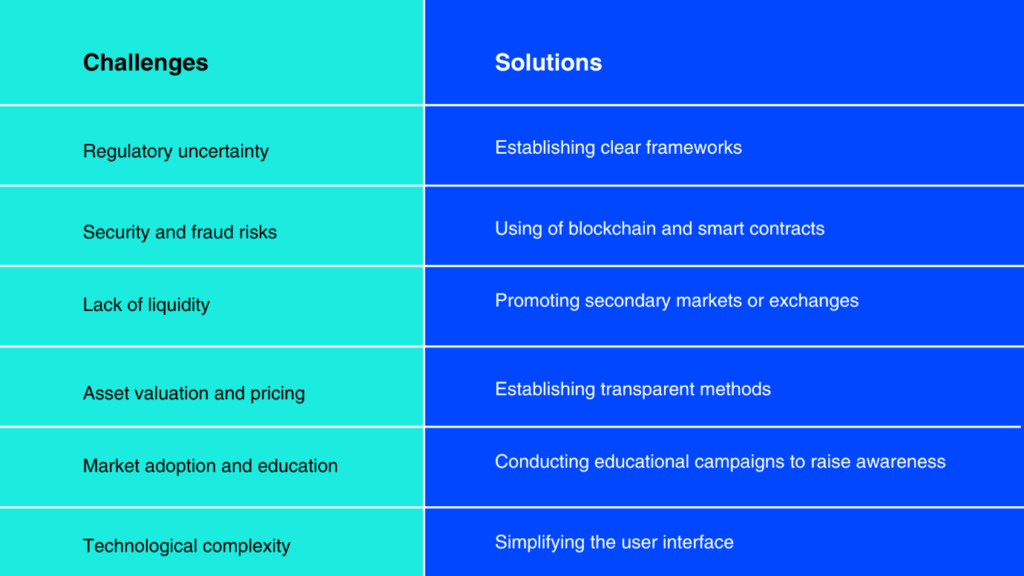

Challenges and Solutions in the Process of Tokenization

As tokenization in real-world assets is gaining momentum in the market; several platforms allow their trading and investment. One such platform is STOEX.

STOEX is backed by KALP Distributed Ledger Technology (DLT) and strictly adhered to regulatory compliance, ensuring transparency and liquidity. With its structured approach, stringent security, and commitment to compliance, the platform offers an appealing option for diversified and efficient investing. Its regulation, security measures, focus on usability and customer-centric approach make it stand out as an accessible way of trading tokenized real-world assets.

Additionally, STOEX’s vision is to build a ground with reduced entry barriers and encourage a safe ecosystem for every individual interested in investing in the market. It pulls the strings of financial democratization by bridging the gap between investors and high-worth tokenized RWAs.

Final Reflections

Tokenization is one of the most transforming applications of the modern world, which is changing the dynamics of trading and investments in real-world assets. They provide several benefits including accessibility, liquidity, efficiency, and security. Further blockchain technology provides immutability and transparency in the process. Successful implementations of the tokenization such as COSOLAR and the tokenization of the St. Regis Aspen Resort highlight its potential in the market. Moreover, the integration of tokenization with AI, DeFi, and machine learning provides a better ground for the stakeholders involved. As these concepts are still evolving, various platforms are adding to the layer of opportunities and options within these domains. One such option is STOEX, which allows investors to access the marketplace and trade effortlessly.

Key Takeaways:

- Basics of tokenization and its benefits.

- Case studies from sectors such as real estate and arts.

- Use Cases of Tokenization.

- Its integration with emerging technologies like AI, machine learning, and smart contracts.

- Challenges and Solutions

FAQs

What is tokenization?

Tokenization is the process of converting real-world assets into digital tokens on blockchain technology.

What types of assets can be tokenized?

Real estate, art, commodities, stocks, luxury goods, and more can be tokenized investment and trading.

How does tokenization work?

Tokenization involves selecting an asset, evaluating its value, and creating digital tokens on the blockchain.

What are the benefits of tokenization?

Tokenization offers increased liquidity, fractional ownership, global access, transparency, and lower barriers to entry for investors.

Are tokenized assets safe and secure?

Tokenized assets are secured by blockchain technology, providing transparency and protection against fraud.