On October 8, 2024, Argentina implemented its first legally enforceable smart contract, employing the Cardano blockchain. This method provides the automated process of agreement implementation and management. It smoothens the terms and conditions of the loan repayment process, terminating the dependency on the intermediaries. The incident accentuates the market adoption of technologies like blockchain, smart contracts for tokenization, and many more to make the financial landscape secure, transparent, and inclusive. In this blog post, we will further explore the role of smart contracts for tokenization, how smart contracts work in tokenization, their benefits, and the adoption of smart contracts in financial markets.

Key Takeaways:

- Understand the concept of tokenization and how it applies to real-world assets (RWAs).

- Explore the role of smart contracts in the process of tokenization of real-world assets.

- Benefits of smart contracts for tokenized RWAs

- Step-by-step process of deploying a smart contract

Overview of Tokenization and Tokenized RWAs

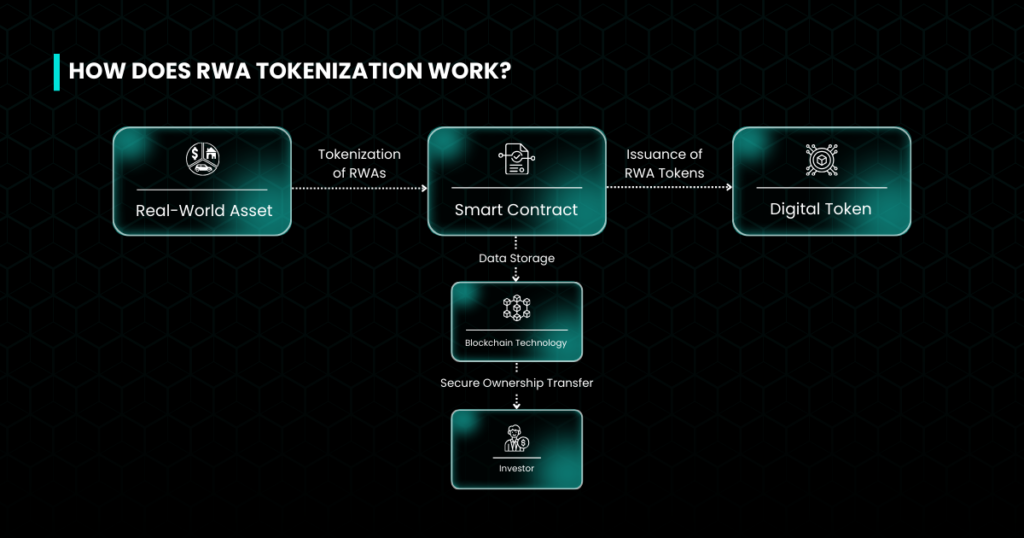

Tokenization of real-world assets is the process of converting their ownership rights into digital tokens on blockchain technology. Real-world asset tokenization examples include real estate, commodities, art, commodities, IP, carbon credits, and renewable energy. Tokenized assets play a pivotal role in reforming the investment and trading process, aligning with the objective of the digital economy. Further, blockchain-based tokenization provides the stakeholders including both investors as well as sponsors with a secure environment to trade and invest in.

How Smart Contracts Work in Tokenization?

Smart contracts are self-executing agreements directly written in the code. They automate the process of transactions, reduce the need to rely on intermediaries and help in managing RWA tokens. Additionally, they enhance security and transparency for the stakeholders involved and hence, provide a clear audit trail, preventing fraud.

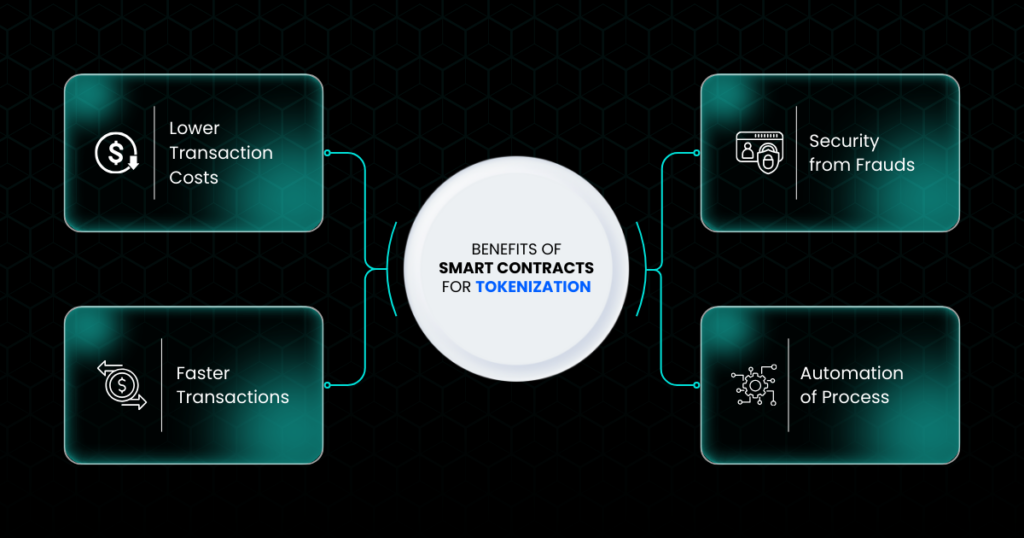

Benefits of Smart Contracts for RWAs Tokenization

Smart contracts in financial markets are transforming the method of trading and investments and further increasing the efficiency of the process. Here are a few notable benefits:

Lower Transaction Costs: Smart contracts minimize the cost of transactions by removing the need for intermediaries like banks, brokers, financial institutions, and trustees. Further, with the automation provided by the smart contracts, fees involving the process of tokenizing RWAs are reduced. This facilitates direct transactions among the parties involved and reduces the additional operational costs.

Faster Transactions: Smart contracts grant real-time transactions as their rules and agreements are pre-defined. This approach makes the process efficient and faster, resulting in instant execution of the transaction. This speed and effectiveness build a trustworthy ecosystem for the stakeholders.

Security from Frauds: Smart contracts are stored in the secure and transparent nodes of blockchain technology. This makes them tamper-proof and transparent, deterring anyone from changing, manipulating, and altering data about ownership and transactions.

Automation of Process: One of the core features of smart contracts is automating the execution of contracts as pre-defined conditions. This framework terminates manual operational activities and human errors.

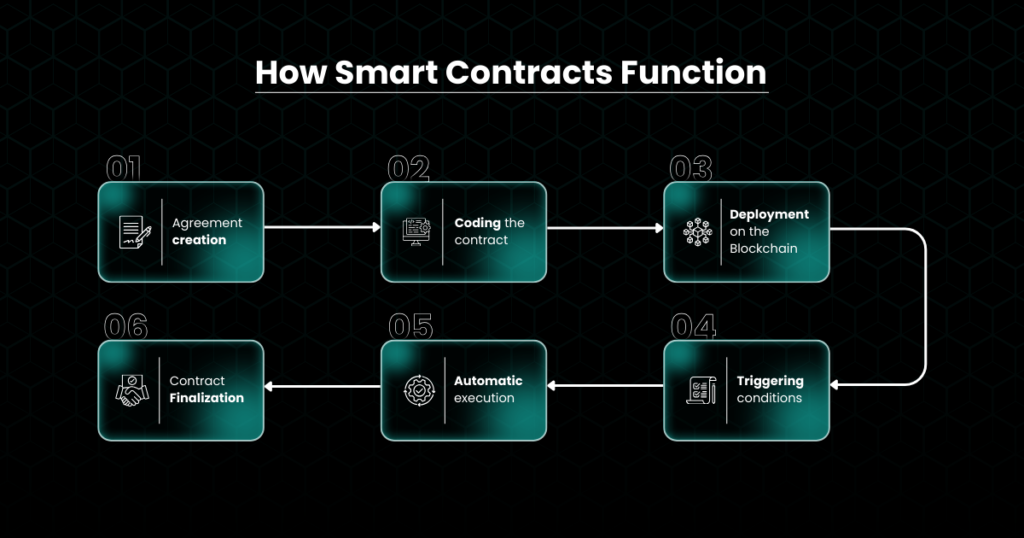

Step-by-Step Breakdown of Smart Contract Operations

Step 1: Agreement Creation

The very first step begins with drafting an agreement by the parties involved and highlighting the rules, terms, and conditions of the contract.

Step 2: Coding the Contract

After the finalization of the terms and conditions of the agreement, developers program the smart contracts whose conditions are written in the code.

Step 3: Deployment on the Blockchain

Afterwards the coding of the terms and conditions, these smart contracts are deployed on blockchain technology, making it immutable and secure.

Step 4: Triggering Conditions

Smart contracts are made to be implemented automatically after meeting the pre-defined conditions. These conditions are certain events that activate a particular response, action, or mechanism.

Step 5: Automatic Execution

Once they are triggered, smart contracts can now execute themselves without any need to rely on human administration.

Step 6: Contract Finalization

Afterward their execution, smart contracts record all the transactions on the blockchain technology. This provides a secure, transparent, and immutable record of transactions.

As tokenization in real-world assets is gaining momentum in the market; several platforms allow their trading and investment. One such platform is STOEX.

STOEX is backed by KALP Distributed Ledger Technology (DLT) and strictly adhered to regulatory compliance, ensuring transparency and liquidity. With its structured approach, stringent security, and commitment to compliance, the platform offers an appealing option for diversified and efficient investing. Its regulation, security measures, focus on usability and customer-centric approach make it stand out as an accessible way of trading tokenized real-world assets.

Additionally, STOEX’s vision is to build a ground with reduced entry barriers and encourage a safe ecosystem for every individual interested in investing in the market. It pulls the strings of financial democratization by bridging the gap between investors and high-worth tokenized RWAs.

Conclusion

Tokenization trends in Finance are growing and major industries are adopting it to make their trading and investing processes more secure, transparent, and inclusive for all. One of the recent headlines about the implementation of Argentina’s first legally enforceable smart contract further underscores the growing importance of technological innovation in the field of financial domain. Integration of smart contracts with tokenization of real-world assets makes trading and investment more inclusive, secure, and transparent.

As these concepts are still evolving, various platforms are adding to the layer of opportunities and options within these domains. One such option is STOEX, which allows investors to access the marketplace and trade effortlessly.

FAQs:

What are smart contracts, and how do they work in RWA tokenization?

Smart contracts are self-executing contracts with the terms of the agreement directly written into code. They automate the processes of tokenizing, transferring, and verifying the ownership of RWAs.

What are the key benefits of tokenizing RWAs with smart contracts?

The benefits of tokenizing RWAs with smart contracts include lower transaction costs, security, automation, and greater transparency.

What are the challenges of tokenizing RWAs?

Challenges include regulatory compliance, legal uncertainties, and technological barriers.

How can tokenization change traditional industries?

Tokenization can democratize access to investment opportunities, reduce barriers to entry, and improve liquidity in industries such as real estate, commodities, and art.

What does the future hold for RWA tokenization?

The future of tokenization involves broader market adoption, greater regulatory clarity, and increased integration with evolving technologies such as decentralized finance (DeFi) platforms.