One of the ongoing trends in the financial arena is the amalgamation of AI and DeFi, offering an abundance of benefits, and outlining their promising future. This is one kind of innovation but is certainly something new as our entire digital landscape is evolving each day. Further, tokenization is another innovative technology that is reforming the ways of investments as well as trading. In this blog post, we will understand the basics of DeFi asset tokenization, the journey of asset tokenization, differences in investment between traditional finance and DeFi asset tokenization, and their key benefits.

Key takeaways

- Basics of decentralized finance (DeFi) and real-world asset tokenization

- Overview of DeFi asset tokenization and its benefits

- Steps involved in the roadmap to asset tokenization

- Role of smart contracts in tokenized asset trading

- DeFi asset tokenization vs. traditional finance

What is Decentralized Finance (DeFi)?

Decentralized Finance (DeFi) is a financial vehicle that leverages blockchain technology, facilitating decentralized transactions without any dependency on intermediaries. The core objective of decentralized finance is to eliminate any mediators or third parties such as banks, brokers, trustees, and other financial institutions. DeFi utilizes a peer-based network for transactions and security protocols to reduce the dependency on any financial companies. Further, smart contracts also play a crucial role in decentralized finance as they automate the process in a transparent and accessible method.

Understanding Real-World Asset Tokenization

Real-world asset (RWA) Tokenization is the process of converting RWAs into digital tokens and representing their ownership rights, on blockchain technology, these tokens can be easily traded on the trading platforms for tokenized real-world assets or exchange platforms. This method enables trading and investing in the digital tokens of real-world assets like real estate, arts, collectibles, stocks, commodities, and other assets. Tokenizing assets brings several advantages such as fractional ownership, increased liquidity, increased accessibility, and inclusivity.

Overview of DeFi Asset Tokenization

DeFi asset tokenization is a term that refers to the process of creating digital tokens representing their ownership rights on a blockchain, removing intermediaries in a decentralized ecosystem. It uses smart contracts. Furthermore, it highlights the wider DeFi framework of encouraging an inclusive environment. This allows stakeholders including investors and traders to invest, trade, and manage tokenized assets without any dependency.

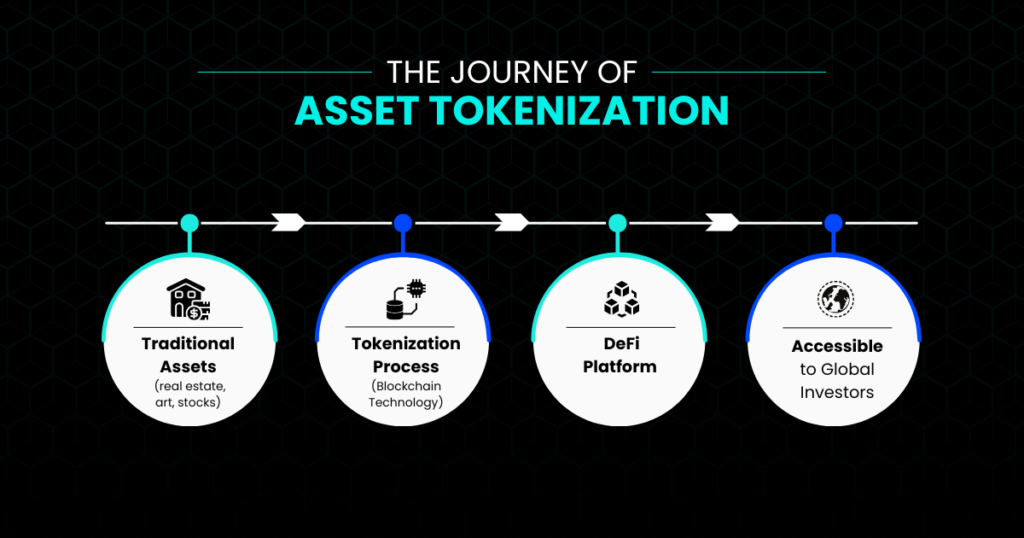

The Roadmap to Asset Tokenization

Step 1: Traditional Assets

The first step to the ladder is to identify the traditional assets with prominent market value to be tokenized. These assets can be real estate, arts, stocks, commodities, and other asset classes.

Step 2: Tokenization Process

The next stage is the tokenization of the asset which encompasses issuance of the digital tokens representing the rights of the real-world assets. This process commenced on blockchain technology leveraging other technologies like smart contracts to automate the process.

Step 3: DeFi Platform

After the process of tokenization, these tokenized assets can be integrated with the decentralized finance platform. This can further add additional marketplace such as decentralized exchanges (DEXs) for these tokens to be traded.

Step 4: Accessible to Global Investors

The last step is to make these tokenized assets available to a larger pool of investors around the globe. This can increase the democratization of investment opportunities in the financial domain.

Role of Smart Contracts in Tokenized Asset Trading

Smart contracts play a crucial role in tokenized asset trading, as they are self-executing agreements with their terms written directly into code. They automate the process by facilitating the creation, management, and transfer of the RWA tokens. The programmability promotes the merger of other financial products and applications like automated lending protocols and decentralized exchanges.

DeFi Asset Tokenization vs. Traditional Finance

Borderless Transactions vs. Geographical Restrictions

Tokenized assets on DeFi platforms being digital interfaces allow transactions around the globe, facilitating investors and users to participate in financial activities.

Traditional finance has restrictions when it comes to borderless transactions as they are limited by the regulatory environments and banking infrastructure.

Lower Costs vs. Higher Costs

Tokenized assets in DeFi environment have lower costs as they do not require any intermediaries like banks, brokers, and other financial institutions. They are functioned through the automated process due to smart contracts.

Traditional finance generally has higher costs due to the involvement of intermediaries like banks, regulators, financial institutions, and trustees.

Fractional Ownership vs. Complete Ownership

Tokenized assets allow shared ownership of precious assets, allowing both institutional as well as retail investors to invest in these assets.

Traditional finance, on the other hand, demands complete ownership or a larger stake in the assets.

24/7 Access vs. Limited Access

Defi asset tokenization can be operated 24/7 and so as the trading and investments in these assets.

Traditional finance operates within a specific hour, limiting the transactions after a certain duration, and delaying the settlement process.

As tokenization in real-world assets is gaining momentum in the market; several platforms allow their trading and investment. One such platform is STOEX.

STOEX is backed by KALP Distributed Ledger Technology (DLT) and strictly adhered to regulatory compliance, ensuring transparency and liquidity. With its structured approach, stringent security, and commitment to compliance, the platform offers an appealing option for diversified and efficient investing. Its regulation, security measures, focus on usability and customer-centric approach make it stand out as an accessible way of trading tokenized real-world assets.

Additionally, STOEX’s vision is to build a ground with reduced entry barriers and encourage a safe ecosystem for every individual interested in investing in the market. It pulls the strings of financial democratization by bridging the gap between investors and high-worth tokenized RWAs.

Conclusion

DeFi asset tokenization is a reforming step in the areas of the financial industry. It offers the investors and other stakeholders, greater accessibility, increased liquidity, efficiency, and inclusivity compared to traditional systems. Further, leveraging blockchain, smart contracts, and other financial innovative technologies, it is creating a more inclusive environment for institutional and retail investors alike.

As these concepts are still evolving, various platforms are adding to the layer of opportunities and options within these domains. One such option is STOEX, which allows investors to access the marketplace and trade effortlessly.

FAQs

What is DeFi asset tokenization?

DeFi asset tokenization involves converting real-world assets into digital tokens that can be traded on blockchain networks.

How does tokenization contribute to financial inclusion?

Tokenizing assets allows smaller investors to access markets that were previously only available to the wealthy or institutional investors.

Can anyone participate in DeFi tokenized asset markets?

Yes, anyone with internet access and a digital wallet can participate in DeFi tokenized asset markets.

What are some examples of tokenized assets in DeFi?

Some of the examples of tokenized assets include real estate, stocks, commodities (like gold), art, and even more niche assets like intellectual property.

What are the risks associated with DeFi tokenization?

The risks associated with DeFi tokenization include smart contract vulnerabilities, regulatory uncertainty, and the volatility of tokenized assets.